在过去忙碌的一周中,各公司营收表现都传递了这样一个信息:经济仍在维持。过去两周,许多大公司都发布了报告,像往常一样,营收季仍然从大银行开始。尽管美联储利率降低,净利息收入有所收紧,但大银行的信贷市场仍然稳固。

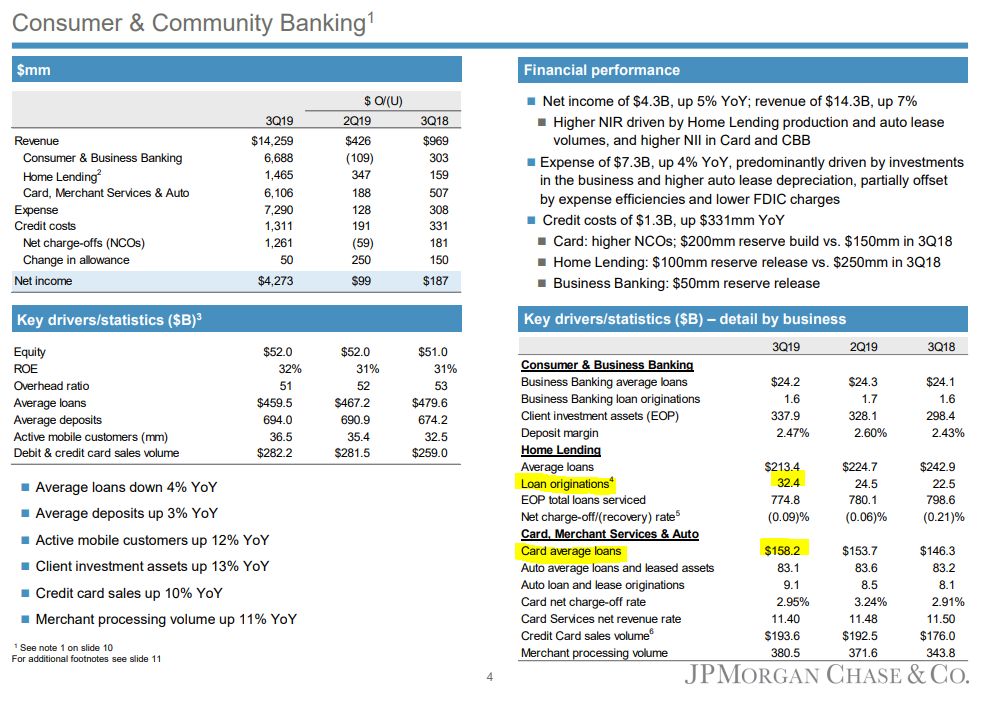

In what has been a busy week, corporate earnings yelled one single clear message: The economy is still holding up. Having seen many big corporations reporting over the past two weeks, the season started as usual with the big banks, which reported a solid credit market despite tightening Net Interest Income due to the lower Fed Funds rate.

美国银行、摩根大通、瑞银以及花旗集团均呈现了非常积极的每股收益增长,而高盛仍然落后,这主要是由于其投资与贷款部门表现不佳。摩根大通的首席执行官杰米·戴蒙在电话报告会议中对看跌的卖方分析师打了强心针,称尽管中美贸易摩擦影响了企业情绪,消费仍在继续,这将继续为美国经济提供动力。

Bank of America, JPMorgan, UBS, Citigroup all reporting encouraging EPS growth, while GS still lags due to mainly its underperforming Investment & Lending Division. Jamie Dimon, CEO of JPM, during the usual earnings conference call reassured the sell-side analysts, who generally reported a very bearish sentiment from their buy-side counterparties, claiming that consumers are still spending, and this will continue to fuel the US economy despite the US-China dispute weighs on corporate sentiment.

再让我们看一下工业方面,卡特彼勒的业绩差强人意,报告发布后股价暴跌。特斯拉、哈雷·戴维森和联合技术则公布了超预期的业绩。麦当劳和孩之宝的营收数据令人堪忧,而宝洁则表现不错。是否是时候考虑投资价值股了呢?

Moving on with industrials, Caterpillar reported disappointing earnings, with the stock plummeting post-release, whilst Tesla, Harley Davidson and United Technologies posted expectation beating results. McDonald’s and Hasbro struggled, while Procter and Gamble thrived. Is it worth positioning on Value stocks?

同时,在电信巨头威瑞森宣布为其无限家庭互联网和5G用户提供12个月免费迪士尼会员资格之后,迪士尼和威瑞森股价均小幅上涨。最后还要提到生物制药公司Biogen,在营收发布后宣布了药品Aducanumab的新监管备案,Aducanumab可减缓早期阿尔茨海默氏病患者的临床症状。该股盘中一度上涨超过36%,市值增加约100亿美元。

On the same page, Disney and Verizon both edged higher after the Telco giant announced to concede a 12-months free Disney+ Membership for its new unlimited Home Internet and 5G subscribers. To conclude the earnings wrap-up, Biogen after earnings release announced a new regulatory filing for Aducanumab, a new drug to reduce clinical decline in patients with early Alzheimer’s disease. The stock climbed more than 36% intraday, adding circa $10bn in Market Capitalisation.

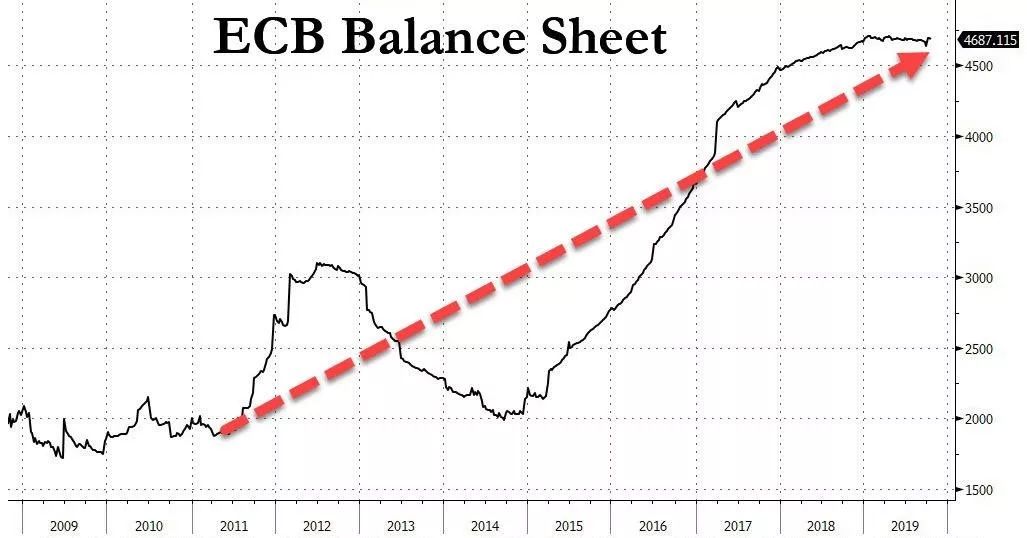

宏观方面,星期四是重要的一天。法国、德国和欧元区制造业采购经理人指数均符合预期,这再次强调了我们已经知道的事实——德国不再是欧洲制造业的引擎。On the Macro-side, Thursday has been “the day”. France, Germany and the Eurozone Manufacturing PMIs all came up in-line with expectations, highlighting what we already knew: Germany is not anymore, the European manufacturing engine. 欧洲央行行长马里奥·德拉吉举行了最后一次媒体新闻发布会,宣布暂时不会再进一步降息,尽管他再次重申了“令人担忧的经济放缓、下行风险和通胀压力减弱”。在他任职的8年期间,欧元区从主权债务危机中复苏,失业率降至7.4%(2008年5月以来最低水平)。另一方面,与耶伦或鲍威尔不同,他在任期内从未提高利率,相反地,他在应对一次次危机时,向金融体系注入更多的流动性,扩大了财富差距(目前是欧洲历史上最高)。

Mario Draghi held his last media press conference, announcing no further rate cuts for the time being, although he once-again reaffirmed “concerning economic slowdown, downside risk and muted inflation pressure”. During his 8 years mandate, the Euro area emerged from a period of sovereign debt crisis and saw unemployment drop to 7.4% (the lowest since May 2008). On the other side of the coin, unlike Yellen or Powell, he was never able to raise rates during his term, instead he widened up the wealth divide (which is now the highest in Europe history) by pumping up more liquidity into the financial system as he fought one crisis after another.

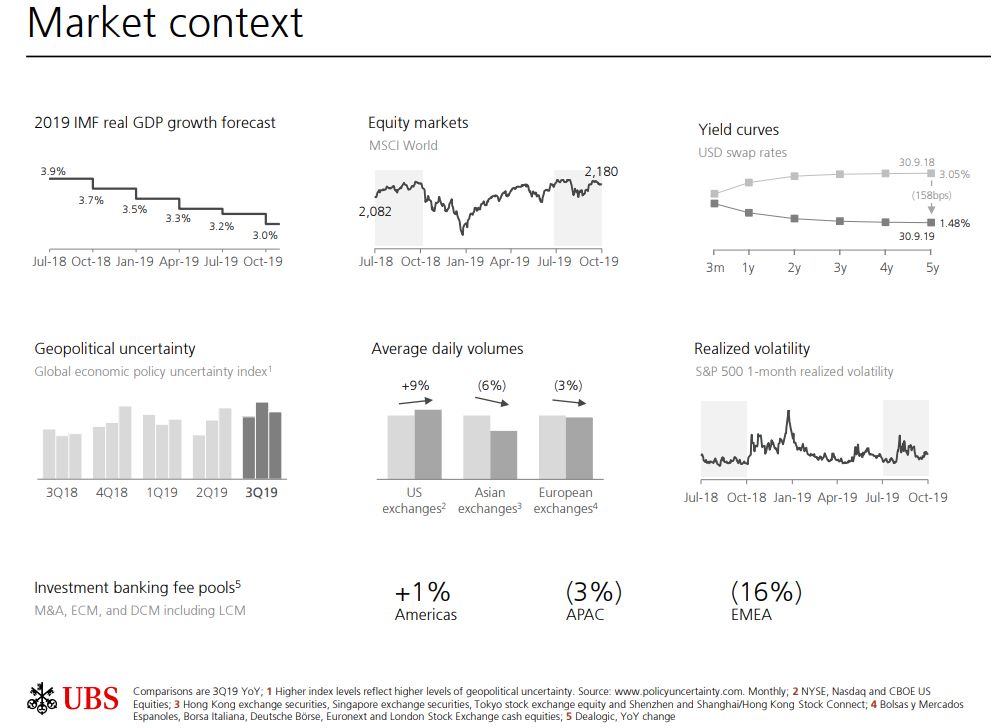

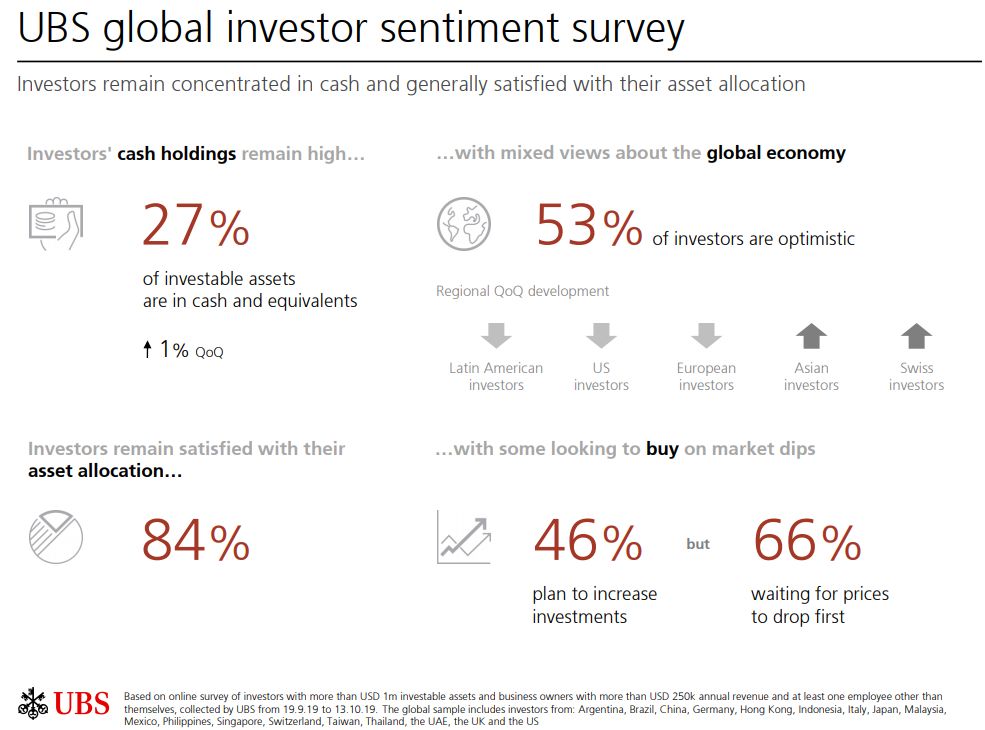

市场仍然缺乏动荡,标普500指数未能持续突破关键的3000阻力位。瑞银刚刚发布了最新的全球投资者信心调查结果,强调了在全球经济悲观情绪和对价格调整期待的影响下,活跃的投资经理仍然保持高现金持有量。

The market, remains bereft of volatility, with the S&P 500 failing to amount a sustained break above the key 3000 resistance level. UBS just released their update global investor sentiment survey results, which highlighted how active managers still remain high in cash holdings amid global economy pessimism and hopes of a market correction.

下周的宏观焦点

Next week our macro spotlight will be on?

周一 Monday

· 贷款增长–欧元区

Loan Growth – Eurozone

· 芝加哥联储国家活动指数-美国

Chicago Fed National Activity Index - US

· 批发库存–美国

Wholesale Inventory – US

· 达拉斯联储制造业指数-美国

Dallas Fed Manufacturing Index - US

周二 Tuesday

· 东京核心消费者价格指数(CPI) –日本

Tokyo Core CPI – Japan

· 进口价格–德国

Import Prices – Germany

· 英国央行消费者信贷

BoE Consumer Credit – UK

· 红皮书–美国

Redbook – US

· 代售房屋销量-美国

Pending Home Sales – US

· 谘商会消费者信心指数-美国

CB Consumer Confidence – US

· 标普房屋价格指数-美国

S&P Home Price Index - US

周三 Wednesday

· 零售业销量-日本

Retail Sales – Japan

· 通货膨胀率–澳大利亚

Inflation Rate – Australia

· 家庭消费–法国

Household Consumption – France

· 消费者/商业信心–意大利

Consumer/Business Confidence – Italy

· 经济、工业、服务业情绪指数–欧元区

Economic, Industrial, Service Sentiment – Eurozone

· 消费者信心–欧元区

Consumer Confidence – Eurozone

· GDP增长率–美国

GDP Growth Rate – US GDP

· 通货膨胀率–德国

Inflation Rate – Germany

· 美联储利率决定

Fed Interest Rate Decision

周四 Thursday

· 工业生产量–日本

Industrial Production – Japan

· 捷孚凯消费者信心指数-英国

Gfk Consumer Confidence – UK

· 国家统计局制造业指数-中国

NBS Manufacturing Index – China

· 失业率–意大利

Unemployment Rate – Italy

· 失业率–欧元区

Unemployment Rate – Eurozone

· GDP增长率–欧元区

GDP Growth Rate – Eurozone

· 个人收入与支出–美国

Personal Income & Spending – US

· 持续失业救济申请数–美国

Continuing Jobless Claims – US

· 初次失业救济申请数-美国

Initial Jobless Claims – US

· 芝加哥PMI –美国

Chicago PMI – US

周五 Friday

· 财新制造业PMI –中国

Caixin Manufacturing PMI – China

· 非农就业人数–美国

Non-Farm Payrolls – US

· 失业率-美国

Unemployment Rate – US

· 马基制造业采购经理人指数(PMI)-美国

Markit Manufacturing PMI – US

· ISM制造业PMI-美国

ISM Manufacturing PMI - US

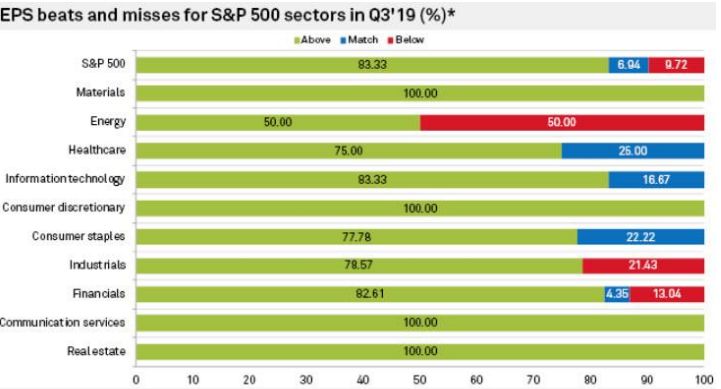

本周图表

Chart of the Week

本周事件

Fact of the Week

亚马逊两年来首次宣布出现利润下降,原因是亚马逊网络服务亏损和自2001年以来最低的总体收入增速。消息发布后股价在盘后交易中下跌了约7%。

Amazon stock price slumped about 7 percent after market hours as the tech giant reported its first profit drop in two years amid AWS miss and overall slowest revenue growth rate since 2001.

本周摘录

Quote of the Week

“自9月初上届理事会会议以来不断发布的数据,证实了我们先前对欧元区增长动力长期疲软、持续存在的重大下行风险以及通胀压力减弱的评估。”——欧洲央行行长马里奥·德拉吉在上周四最后一次新闻发布会上说

“The incoming data since the last governing council meeting in early September confirm our previous assessment of a protracted weakness in the euro area growth dynamics, the persistence of prominent downside risk and muted inflation pressure” ——Mario Draghi, ECB Governor during his last press conference last Thursday

扫描二维码,关注瑞麟资本

点击↓阅读原文,查看瑞麟资本官网,了解更多金融资讯